Environment, Social, Governance

Throughout its history, Wellesley has remained committed to developing the cleanest portfolio of hydrocarbons while minimising the impact of our work.

Our ESG goals are championed at every level of the organisation, from daily operations to our future planning.

Powered From Norway’s Shores

By powering offshore production facilities with electricity delivered from shore, Wellesley considerably reduces the amount of CO2 emitted during field life. All of Wellesley’s oil developments will be powered from shore. Where possible, gas developments will be too.

million tonnes CO2

saved per year

Fully Electrified Production

Wellesley’s strategy is to explore for oil near facilities where electrification is in place or planned.

Our recent “FANTA” discoveries in the Northern North Sea are a perfect example of this. Thanks to the use of fully electrified platforms, the FANTA area developments will have a carbon intensity of less than 2kg CO2/boe. This ensures these discoveries have a low impact on the environment.

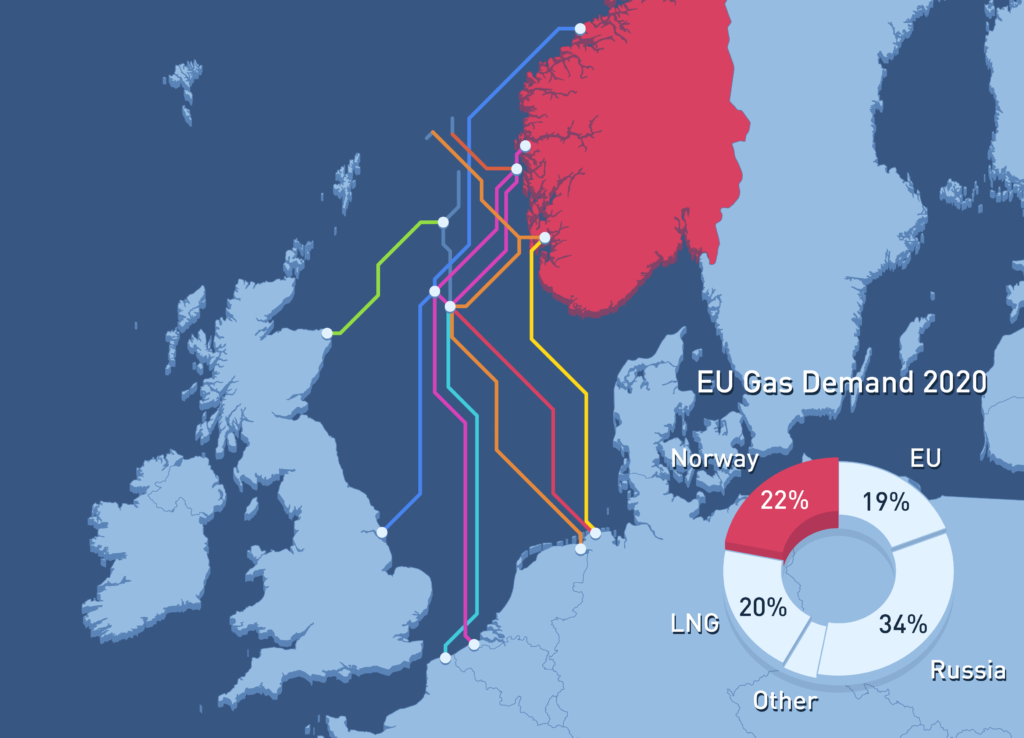

Gas to Europe

Gas displaces coal-fired electricity, balances intermittent wind and solar generation and enables the production of blue hydrogen, making it a key fuel in the energy transition.

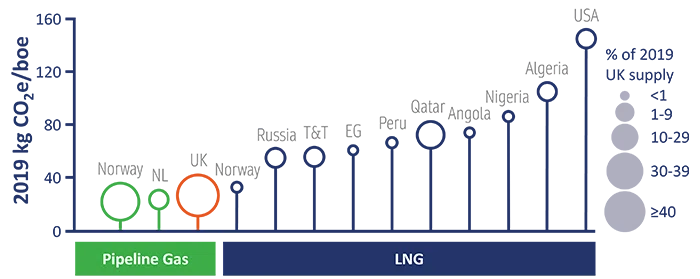

Norway is the UK’s largest import supplier of gas. Due to Norway’s newer infrastructure and ability to power production platforms from shore, Norwegian gas has a lower carbon footprint than the UK’s domestic pipeline gas, and a significantly lower CO2 intensity than LNG import sources.

Norway’s plentiful, low carbon pipeline gas enables Europe to reduce its CO2 emissions, and gives security of energy supply to its customers.

Wellesley’s ESG Commitment

Discover more about Wellesley’s history, team and values on our About Page.

Wellesley recognises the importance of the energy transition and is determined to be part of the solution, by finding and developing the cleanest possible sources of hydrocarbons. By setting and upholding ambitious ESG goals across the organisation, we intend to minimise our impact on the environment.

As an OECD economy, Norway offers low geopolitical risk together with a stable regulatory regime for oil and gas operations. Norway’s management of its hydrocarbon resources is regarded as a best practice model in distributing and preserving economic benefits for its citizens. Norway is one of the least corrupt countries in the world to do business and is ranked 4th globally in the Transparency International Corruption Perceptions Index 2021.

Discover our ESG goals:

-

Explore around electrified hosts

We will connect new discoveries to existing infrastructure, which is powered by renewable Norwegian electricity. This enables us to significantly reduce the impact of new projects while maximising the value of existing infrastructure.

-

Explore for gas and zero CO2 oil

Our exploration efforts will explicitly target advantaged hydrocarbons that will enable the energy transition and have a positive ESG footprint.

-

Map and record scope 1 and 2 emissions that are discharged when we operate.

By measuring the emissions produced by our operations, whether directly or indirectly, Wellesley will be able to more efficiently manage and reduce our footprint.

-

Reduce company travel by 50% from 2019 by switching to virtual meetings

While travel is sometimes a necessity for safe and efficient operations, Wellesley is using virtual meetings to help minimise our footprint.

-

Record and report LTIFR each quarter

Lost Time Injury Frequency (LTIFR) refers to the number of workplace injuries which result in an employee’s inability to work the next full day. Recording and reporting this metric helps Wellesley to continually improve and enhance working conditions for our teams.

-

Record and report the percentage of renewable energy used to run the company

Each quarter, Wellesley will report its electric bill. By measuring the amount of renewable energy we are consuming and what percentage it equates to overall, Wellesley will be able to find and improve our consumption and source of energy over time.

2023 Factbook

Our factbook contains the latest management view of the production forecasts from Wellesley’s portfolio.